7 Free Market Transportation: Denationalizing the Roads #

Were a government to demand the sacrifice of 46,700 citizens1 each year, there is no doubt that an outraged public would revolt. If an organized religion were to plan the immolation of 523,335 of the faithful in a decade,2 there is no question that it would be toppled. Were there a Manson-type cult that murdered 790 people to celebrate Memorial Day, 770 to usher in the Fourth of July, 915 to commemorate Labor Day, 960 at Thanksgiving, and solemnized Christmas with 355 more deaths,3 surely The New York Times would wax eloquent about the carnage, calling for the greatest manhunt this nation has ever seen. If Dr. Spock were to learn of a disease that killed 2,077 children4 under the age of five each year, or were New York City’s Andrew Stein to uncover a nursing home that allowed 7,346 elderly people to die annually,5 there would be no stone unturned in their efforts to combat the enemy. To compound the horror, were private enterprise responsible for this butchery, a cataclysmic reaction would ensue: investigation panels would be appointed, the justice department would seek out antitrust violations, company executives would be jailed, and an outraged hue and cry for nationalization would follow.

The reality, however, is that the government is responsible for such slaughter—the toll taken on our nation’s roadways. Whether at the local, state, regional, or national level, it is government that builds, runs, manages, administers, repairs, and plans for the roadway network. There is no need for the government to take over; it is already fully in charge, and with a vengeance. I believe there is a better way: the marketplace. Explaining how a free market can serve to provide road and highway service, as it has furnished us with practically every other good and service at our disposal, is the objective of this article.

Before dismissing the idea as impossible, consider the grisly tale of government road management. Every year since 1925 has seen the death of more than 20,000 people. Since 1929, the yearly toll has never dropped below 30,000 per year. In 1962, motor vehicle deaths first reached the 40,000 plateau and have not since receded below that level. To give just a hint of the callous disregard in which human life is held by the highway authorities, consider the following statement about the early days of government highway design and planning:

The immediate need was to get the country out of the mud, to get a connected paved road system that would connect all county seats and population centers with mudless, dustless roads. These were the pioneering years. Safety, volume, and traffic operations were not considered a problem. But by the middle thirties there was an awakening and a recognition that these elements were vital to efficient and safe operation of the highway system. Emphasis added 6

By the “middle thirties,” indeed, nearly one-half million people had fallen victim to traffic fatalities.7

Rather than invoking indignation on the part of the public, government management of the roads and highways is an accepted given. Apart from a Ralph Nader, who only inveighs against unsafe vehicles (only a limited part of the problem), there is scarcely a voice raised in opposition.

The government seems to have escaped opprobrium because most people blame traffic accidents on a host of factors other than governmental mismanagement: drunkenness, speeding, lack of caution, mechanical failures, etc. Typical is the treatment undertaken by Sam Peltzman,8 who lists no less than thirteen possible causes of accident rates without even once mentioning the fact of government ownership and management.

Vehicle speed… alcohol consumption… the number of young drivers… changes in drivers’ incomes… the money costs of accidents… the average age of cars… the ratio of new cars to all cars (because it has been suggested that while drivers familiarize themselves with their new cars, accident risk may increase)… traffic density… expenditures on traffic-law enforcement by state highway patrols… expenditures on roads… the ratio of imports to total cars (because there is evidence that small cars are more lethal than large cars if an accident occurs)… education of the population… and the availability of hospital care (which might reduce deaths if injury occurs).

Further, David M. Winch cites another reason for public apathy: the belief that “many persons killed on the roads are partly to blame for their death.”9 True, many victims of road accidents are partly responsible. But this in no way explains public apathy toward their deaths. For people killed in New York City’s Central Park during the late evening hours, are also at least partially to blame for their own deaths; it takes a monumental indifference, feeling of omnipotence, absentmindedness or ignorance to embark upon such a stroll. Yet the victims are pitied, more police are demanded, and protests are commonly made.

The explanation of apathy toward highway mismanagement that seems most reasonable is that people simply do not see any alternative to government ownership. Just as no one “opposes” or “protests” a volcano, which is believed to be beyond the control of man, there are very few who oppose governmental roadway control. Along with death and taxes, state highway management seems to have become an immutable, if unstated, fact. The institution of government has planned, built, managed and maintained our highway network for so long that few people can imagine any other workable possibility. While Peltzman puts his finger on the proximate causes of highway accidents, such as excessive speed and alcohol, he has ignored the agency, government, which has set itself up as the manager of the roadway apparatus. This is akin to blaming a snafu in a restaurant on the fact that the oven went out, or that the waiter fell on a slippery floor with a loaded tray. Of course the proximate causes of customer dissatisfaction are uncooked meat or food in their laps. Yet how can these factors be blamed, while the part of restaurant management is ignored? It is the restaurant manager’s job to insure that the ovens are performing satisfactorily, and that the floors are properly maintained. If he fails, the blame rests on his shoulders, not on the ovens or floors. We hold the trigger man responsible for murder, not the bullet.

The same holds true with highways. It may well be that speed and alcohol are deleterious to safe driving; but it is the road manager’s task to ascertain that the proper standards are maintained with regard to these aspects of safety. If unsafe conditions prevail in a private, multistory parking lot, or in a shopping mall, or in the aisles of a department store, the entrepreneur in question is held accountable. It is he who loses revenue unless and until the situation is cleared up. It is logically fallacious to place the blame for accidents on unsafe conditions, while ignoring the manager whose responsibility it is to ameliorate these factors. It is my contention that all that is needed to virtually eliminate highway deaths is a nonutopian change, in the sense that it could take place now, even given our present state of knowledge, if only society would change what it can control: the institutional arrangements that govern the nation’s highways.

Answering the Charge “Impossible” #

Before I explain how a fully free market in roads might function, it appears appropriate to discuss the reasons why such a treatment is likely not to receive a fair hearing.

A fully private market in roads, streets, and highways is likely to be rejected out of hand, first, because of psychological reasons. The initial response of most people goes something as follows:

Why, that’s impossible. You just can’t do it. There would be millions of people killed in traffic accidents; traffic jams the likes of which have never been seen would be an everyday occurrence; motorists would have to stop every twenty-five feet and put one-hundredth of a penny in each little old lady’s toll box. Without eminent domain, there would be all sorts of obstructionists setting up roadblocks in the oddest places. Chaos, anarchy, would reign. Traffic would grind to a screeching halt, as the entire fabric of the economy fell about our ears.

If we were to divide such a statement into its cognitive and psychological (or emotive) elements, it must be stated right at the outset that there is nothing at all reprehensible about the intellectual challenge. Far from it. Indeed, if these charges cannot be satisfactorily answered, the whole idea of private roads shall have to be considered a failure.

But there is also an emotive element which is responsible, perhaps, not for the content of the objection, but for the hysterical manner in which it is usually couched and the unwillingness, even, to consider the case. The psychological component stems from a feeling that government road management is inevitable and that any other alternative is therefore unthinkable. It is this emotional factor that must be flatly rejected.

We must realize that just because the government has always10 built and managed the roadway network, this is not necessarily inevitable, the most efficient procedure, nor even justifiable. On the contrary, the state of affairs that has characterized the past is, logically, almost entirely irrelevant. Just because “we have ‘always’ exorcised devils with broomsticks in order to cure disease” does not mean that this is the best way.

We must ever struggle to throw off the thralldom of the status quo. To help escape “the blinds of history” consider this statement by William C. Wooldridge:

Several years ago I was a student at St. Andrews University in Scotland, and I found that placing a telephone call constituted one of the environment’s greatest challenges. Private phones were too expensive to be commonplace, so a prospective telephoner first had to accumulate four pennies for each call he desired to make, a project complicated by the absence of any nearby commercial establishment open beyond the hour of six or seven. Next, the attention of an operator had to be engaged, in itself a sometimes frustrating undertaking, whether because of inadequate manpower or inadequate enthusiasm on the switchboard I never knew. Finally, since the landward side of town apparently boasted no more telephones than the seaward, a long wait frequently followed even a successful connection, while whoever had answered the phone searched out the party for whom the call was intended. A few repetitions of this routine broke my telephone habit altogether, and I joined my fellow students in communicating in person or by message when it was feasible, and not communicating at all when it was not.

Nevertheless, the experience rankled, so I raised the subject one night in the cellar of a former bishop’s residence, which now accommodates the student union’s beer bar. Why were the telephones socialized? Why weren’t they a privately owned utility, since there was so little to lose in the way of service by denationalization?

The reaction was not, as might be expected, in the least defensive, but instead positively condescending. It should be self-evident to even a chauvinistic American that as important a service as the telephone system could not be entrusted to private business. It was inconceivable to operate it for any other than the public interest. Who ever had heard of a private telephone company?

That incredulity slackened only slightly after a sketchy introduction to Mother Bell (then younger and less rheumatic than today), but at least the American company’s example demonstrated that socialized telephone service was not an invariable given in the equation of the universe. My friends still considered the private telephone idea theoretically misbegotten and politically preposterous, but no longer could it remain literally inconceivable, for there we all were sitting around a table in the bishop’s basement talking about it. It had been done. It might—heaven for-fend—be done again. The talk necessarily shifted from possibility to desirability, to what lawyers call the merits of the case.

Like the St. Andrews students, Americans show a disposition to accept our government’s customary functions as necessarily the exclusive province of government; when city hall has always done something, it is difficult to imagine anyone else doing it.

When an activity is being undertaken for the first time, the operation of the Telstar communications satellite, for instance, people keenly feel and sharply debate their option for public or private ownership. Discussion of the costs and advantages of each alternative accompanies the final choice. But once the choice is made and a little time passes, an aura of inevitability envelops the status quo, and consciousness of any alternative seeps away with time.

Today, most Americans probably feel the telegraph naturally belongs within the private sphere, and few doubt the post office should naturally be a public monopoly. “Naturally,” however, in such a context means only that’s-the-way-it’s-been-for-as-long-as-we-can-remember, an Americanized version of Pope’s declaration that “Whatever is right.” Yet few could think of a convincing a priori rationale for distinguishing the postal from the telegraphic mode of communication. At least one postmaster general could not: in 1845 his annual report prophesied intolerable competition from the telegraph and suggested it might appropriately be committed to the government. At that early stage in its history, the telegraph might conceivably have become a government monopoly for the same reasons the post office already was, but the mere passage of time has obliterated any consideration of whether they were good reasons or bad reasons.11

In advocating a free market in roads, on one level, we shall be merely arguing that there is nothing unique about transportation; that the economic principles we accept as a matter of course in practically every other arena of human experience are applicable here, too. Or at the very least, we cannot suppose that ordinary economic laws are not apropos in road transportation until after the matter has been considered in some detail.

Says Gabriel Roth:

There is an approach to the problem of traffic congestion—the economic approach—which offers a rational and practical solution…. The first step is to recognize that road space is a scarce resource. The second, to apply to it the economic principles that we find helpful in the manufacture and distribution of other scarce resources, such as electricity or motor cars or petrol. There is nothing new or unusual about these principles, nor are they particularly difficult. What is difficult is to apply them to roads, probably because we have all been brought up to regard roads as community assets freely available to all comers. The difficulty does not lie so much in the technicalities of the matter, but rather in the idea that roads can usefully be regarded as chunks of real estate.12

Unfortunately, even those economists who, like Roth, call explicitly for a consideration of the similarities between roads and other goods are unwilling to carry the analogy through to its logical conclusion: free enterprise highways and streets. Instead, they limit themselves to advocacy of road pricing, but to be administered, always, by governmental authorities.

What reasons are there for advocating the free market approach for the highway industry? First and foremost is the fact that the present government ownership and management has failed. The death toll, the suffocation during urban rush hours, and the poor state of repair of the highway stock, are all eloquent testimony to the lack of success which has marked the reign of government control. Second, and perhaps even more important, is a reason for this state of affairs. It is by no means an accident that government operation has proven to be a debacle, and that private enterprise can succeed where government has failed.

It is not only that government has been staffed with incompetents. The roads authorities are staffed, sometimes, with able management. Nor can it be denied that at least some who have achieved high rank in the world of private business have been incompetent. The advantage enjoyed by the market is the automatic reward and penalty system imposed by profits and losses. When customers are pleased, they continue patronizing those merchants who have served them well. These businesses are thus allowed to earn a profit. They can prosper and expand. Entrepreneurs who fail to satisfy, on the other hand, are soon driven to bankruptcy.

This is a continual process repeated day in, day out. There is always a tendency in the market for the reward of the able, and the deterrence of those who are not efficient. Nothing like perfection is ever reached, but the continual grinding down of the ineffective, and rewarding of the competent, brings about a level of managerial skill unmatched by any other system. Whatever may be said of the political arena, it is one which completely lacks this market process. Although there are cases where capability rises to the fore, there is no continual process which promotes this.

Because this is well known, even elementary, we have entrusted the market to produce the bulk of our consumer goods and capital equipment. What is difficult to see is that this analysis applies to the provision of roads no less than to fountain pens, frisbees, or fishsticks.

A Free Market in Roads #

Let us now turn to a consideration of how a free market in roads might operate.13 Along the way, we will note and counter the intellectual objections to such a system. All transport thoroughfares would be privately owned: not only the vehicles, buses, trains, automobiles, trolleys, etc., that travel upon them, but the very roads, highways, byways, streets, sidewalks, bridges, tunnels, crosswalks themselves upon which journeys take place. The transit corridors would be as privately owned as is our fast food industry.

As such, all the usual benefits and responsibilities that are incumbent upon private enterprise would affect roads. The reason a company or individual would want to build or buy an already existing road would be the same as in any other business—to earn a profit. The necessary funds would be raised in a similar manner—by floating an issue of stock, by borrowing, or from past savings of the owner. The risks would be the same—attracting customers and prospering, or failing to do so and going bankrupt. Likewise for the pricing policy; just as private enterprise rarely gives burgers away for free, use of road space would require payment. A road enterprise would face virtually all of the problems shared by other businesses: attracting a labor force, subcontracting, keeping customers satisfied, meeting the price of competitors, innovating, borrowing money, expanding, etc. Thus, a highway or street owner would be a businessman as any other, with much the same problems, opportunities, and risks.

In addition, just as in other businesses, there would be facets peculiar to this particular industry. The road entrepreneur would have to try to contain congestion, reduce traffic accidents, plan and design new facilities in coordination with already existing highways, as well as with the plans of others for new expansion. He would have to set up the “rules of the road” so as best to accomplish these and other goals. The road industry would be expected to carry on each and every one of the tasks now undertaken by public roads authorities: fill potholes, install road signs, guardrails, maintain lane markings, repair traffic signals, and so on for the myriad of “road furniture” that keeps traffic moving.

Applying the concepts of profit and loss to the road industry, we can see why privatization would almost certainly mean a gain compared to the present nationalized system of road management.

As far as safety is concerned, presently there is no road manager who loses financially if the accident rate on “his” turnpike increases, or is higher than other comparable avenues of transportation. A civil servant draws his annual salary regardless of the accident toll piled up under his domain. But if he were a private owner of the road in question, in competition with numerous other highway companies (as well as other modes of transit such as airlines, trains, boats, etc.), completely dependent for financial sustenance on the voluntary payments of satisfied customers, then he would indeed lose out if his road compiled a poor safety record (assuming that customers desire, and are willing to pay for, safety). He would, then, have every incentive to try to reduce accidents, whether by technological innovations, better rules of the road, improved methods of selecting out drunken and other undesirable drivers, etc. If he failed, or did less well than his competition, he eventually would be removed from his position of responsibility. Just as we now expect better mousetraps from a private enterprise system which rewards success and penalizes failure, so could we count on a private ownership setup to improve highway safety. Thus, as a partial answer to the challenge that private ownership would mean the deaths of millions of people in traffic accidents, we reply, “There are, at present, millions of people who have been slaughtered on our nation’s highways; a changeover to the enterprise system would lead to a precipitous decline in the death and injury rate, due to the forces of competition.”

Another common objection to private roads is the spectre of having to halt every few feet and toss a coin into a tollbox. This simply would not occur on the market. To see why not, imagine a commercial golf course operating on a similar procedure: forcing the golfers to wait in line at every hole, or demanding payment every time they took a swipe at the ball. It is easy to see what would happen to the cretinous management of such an enterprise: it would very rapidly lose customers and go broke.

If roads were privately owned, the same process would occur. Any road with say, 500 toll booths per mile, would be avoided like the plague by customers, who would happily patronize a road with fewer obstructions, even at a higher money cost per mile. This would be a classical case of economies of scale, where it would pay entrepreneurs to buy the toll collection rights from the millions of holders, in order to rationalize the system into one in which fewer toll gates blocked the roads. Streets that could be so organized would prosper as thoroughfares; others would not. So even if the system somehow began in this patchwork manner, market forces would come to bear, mitigating the extreme inefficiency.

There is no reason, however, to begin the market experiment in this way. Instead of arbitrarily assigning each house on the block a share of the road equal to its frontage multiplied by one-half the width of the street in front of it (the way in which the previous example was presumably generated in someone’s nightmare vision), there are other methods more in line with historical reality and with the libertarian theory of homesteading property rights.

One scenario would follow the shopping center model: a single owner-builder would buy a section of territory, build roads, and (fronting them) houses. Just as many shopping center builders maintain control over parking lots, malls, and other “in common” areas, the entrepreneur would continue the operation of common areas such as the roads, sidewalks, etc. Primarily residential streets might be built in a meandering, roundabout manner replete with cul-de-sacs, to discourage through travel. Tolls for residents, guests, and deliveries might be pegged at low levels, or be entirely lacking (as in the case of modern shopping centers), while through traffic might be charged at prohibitive rates. Standing in the wings, ensuring that the owner effectively discharges his responsibilities, would be the profit and loss system.

Consider now a road whose main function is to facilitate through traffic. If it is owned by one person or company, who either built it or bought the rights of passage from the previous owners, it would be foolish for him to install dozens of toll gates per mile. In fact, toll gates would probably not be the means of collection employed by a road owner at all. There now exist highly inexpensive electrical device14 which can register the passage of an automobile past any fixed point on a road. Were suitable identifying electronic tapes attached to the surface of each road vehicle, there would be no need for a time-wasting, labor costly system of toll collection points. Rather, as the vehicle passes the checkpoint, the electrical impulse set up can be transmitted to a computer which can produce one monthly bill for all roads used, and even mail it out automatically. Road payments could be facilitated in as unobtrusive a manner as utility bills are now.

Then there is the eminent domain challenge: the allegation that roads could not be efficiently constructed without the intermediation of government-imposed eminent domain laws which are not at the disposal of private enterprise. The argument is without merit.

We must first realize that even with eminent domain, and under the system of government road construction, there are still limits as to where a new road may be placed. Not even a government could last long if it decided to tear down all the skyscrapers in Chicago’s Loop in order to make way for yet another highway. The logic of this limitation is obvious: it would cost billions of dollars to replace these magnificent structures; a new highway near these buildings, but one which did not necessitate their destruction, might well be equally valuable, but at an infinitesimal fraction of the cost.

With or without eminent domain, then, such a road could not be built. Private enterprise could not afford to do so, because the gains in siting the road over carcasses of valuable buildings would not be worthwhile; nor could the government accomplish this task, while there was still some modicum of common sense prohibiting it from operating completely outside of any economic bounds.

It is true that owners of land generally thought worthless by other people would be able to ask otherwise exorbitant prices from a developer intent upon building a straight road. Some of these landowners would demand high prices because of psychic attachment (e.g., the treasured old homestead); others solely because they knew that building plans called for their particular parcels, and they were determined to obtain the maximum income possible.

But the private road developer is not without defenses, all of which will tend to lower the price he must pay. First, there is no necessity for an absolutely straight road, nor even for one that follows the natural contours of the land. Although one may prefer, on technical grounds, path A, it is usually possible to utilize path B… Z, all at variously higher costs. If so, then the cheapest of these alternatives provides an upper limit to what the owners along path A may charge for their properties. For example, it may be cheaper to blast through an uninhabited mountain rather than pay the exorbitant price of the farmer in the valley; this fact tends to put a limit upon the asking price of the valley farmer.

Second, the road developer, knowing that he will be satisfied with any of five trajectories, can purchase options to buy the land along each site. If a recalcitrant holdout materializes on any one route, he can shift to his second, third, fourth or fifth choice. The competition between owners along each of these passageways will tend to keep the price down.

Third, in the rare case of a holdout who possesses an absolutely essential plot, it is always possible to build a bridge over this land or to tunnel underneath. Ownership of land does not consist of property rights up to the sky or down to the core of the Earth; the owner cannot forbid planes from passing overhead, nor can he prohibit a bridge over his land, as long as it does not interfere with the use of his land. Although vastly more expensive than a surface road, these options again put an upper bound on the price the holdout can insist upon.

There is also the fact that land values are usually influenced by their neighborhood. What contributes to the value of a residence is the existence of neighboring homes, which supply neighbors, friends, companionship. Similarly, the value of a commercial enterprise is enhanced by the proximity of other businesses, customers, contacts, even competitors. In New York City, the juxtaposition of stock brokerage firms, flower wholesalers, a jewelry exchange, a garment district, etc., all attest to the value of being located near competitors. If a road 150 feet wide sweeps through, completely disrupting this “neighborliness,” much of the value of the stubborn landowner’s property is dissipated. The risk of being isolated again puts limitations upon the price which may be demanded.

In an out-of-the-way, rural setting, a projected road may not be expected to attract the large number of cash customers necessary to underwrite lavish expenditures on the property of holdouts. However, it will be easier to find alternative routes in a sparsely settled area. Urban locations present the opposite problem: it will be more difficult to find low-cost alternatives, but the expected gains from a road which is expected to carry millions of passengers may justify higher payments for the initial assemblage.

Of course, eminent domain is a great facilitator; it eases the process of land purchase. Seemingly, pieces of land are joined together at an exceedingly low cost. But the real costs of assemblage are thereby concealed. Landowners are forced to give up their property at prices determined to be “fair” by the federal bureaucracy, not at prices to which they voluntarily agree. While it appears that private enterprise would have to pay more than the government, this is incorrect. The market will have to pay the full, voluntary price, but this will, paradoxically, be less than the government’s real payment (its money payments plus the values it has forcibly taken from the original owners). This is true because the profit incentive to reduce costs is completely lacking in state “enterprise.” Furthermore, the extra costs undergone by the government in the form of bribes, rigged bidding, cost-plus contracts, etc., often would bloat even limited government money outlays past the full costs of private road developers.

Another objection against a system of private roads is the danger of being isolated. The typical nightmare vision runs somewhat as follows:

A man buys a piece of land. He builds a house on it. He stocks it with food, and then brings his family to join him. When they are all happily ensconced, they learn that the road fronting their little cottage has been purchased by an unscrupulous street-owning corporation, which will not allow him or his family the use of the road at any but an indefinitely high price. The family may “live happily ever after”, but only as long as they keep to their own house. Since the family is too poor to afford a helicopter, the scheming road owner has the family completely in his power. He may starve them into submission, if he so desires.

This does indeed appear frightening, but only because we are not accustomed to dealing with such a problem. It could not exist under the present system, so it is difficult to see how it could be solved by free market institutions. Yet, the answer is simple: no one would buy any plot of land without first insuring that he had the right to enter and leave at will.15

Similar contracts are now commonplace on the market, and they give rise to no such blockade problems. Flea markets often rent out tables to separate merchandisers; gold and diamond exchanges usually sublet booths to individual, small merchants; desk space is sometimes available to people who cannot afford an entire office of their own. The suggestion that these contracts are unworkable or unfeasible, on the grounds that the owner of the property might prohibit access to his subtenant, could only be considered ludicrous. Any lawyer who allowed a client to sign a lease which did not specify the rights of access in advance would be summarily fired, if not disbarred. This is true in the present, and would also apply in an era of private roads.

It is virtually impossible to predict the exact future contour of an industry that does not presently exist. The task is roughly comparable to foretelling the makeup of the airline industry immediately after the Wright Brothers’ experiments at Kitty Hawk. How many companies would there be? How many aircraft would each one own? Where would they land? Who would train the pilots? Where could tickets be purchased? Would food and movies be provided in flight? What kinds of uniforms would be worn by the stewardesses? Where would the financing come from? These are all questions not only impossible to have answered at that time, but ones that could hardly have arisen. Were an early advocate of a “private airline industry” pressed to point out, in minute detail, all the answers in order to defend the proposition that his idea was sound, he would have had to fail.

In like manner, advocates of free market roads are in no position to set up the blueprint for a future private market in transport. They cannot tell how many road owners there will be, what kind of rules of the road they will set up, how much it will cost per mile, how the entrepreneurs will seek to reduce traffic accidents, whether road shoulders will be wider or narrower, or which steps will be taken in order to reduce congestion. Nor can we answer many of the thousands of such questions that are likely to arise.

For one thing, these are not the kinds of questions that can be answered in advance with any degree of precision, and not only in transportation. The same limitations would have faced early attempts to specify industrial setups in computers, televisions, or any other industry. It is impossible to foretell the future of industrial events because, given a free market situation, they are the result of the actions of an entire cooperating economy, even though these actions may not be intended by any individual actor.16 Each person bases his actions on the limited knowledge at his disposal.

Nevertheless, we shall attempt a scenario, though not for the purpose of mapping out, forevermore, the shape of the road market of the future. We realize that such patterns must arise out of the actions of millions of market participants, and will be unknown to any of them in advance. Yet if we are to consider objections to a road market intelligently, we must present a general outline of how such a market might function. We will now consider some problems that might arise for a road market, and some possible solutions.

Who will decide upon the rules of the road? #

This question seems important because we are accustomed to governments determining the rules of the road. Some people even go so far as to justify the very existence of government on the ground that someone has to fashion highway rules, and that government seems to be the only candidate.

In the free market, each road owner will decide upon the rules his customers are to follow, just as nowadays rules for proper behavior in some locations are, to a great extent, determined by the owner of the property in question. Thus, roller- and ice-skating emporia decide when and where their patrons may wander, with or without skates. Bowling alleys usually require special bowling shoes, and prohibit going past a certain line in order to knock down the pins. Restaurants demand that diners communicate with their waiter and busboy, and not go marching into the kitchen to consult with the chef.

There are no “God-given” rules of the road. While it might have been convenient had Moses been given a list of the ten best rules for the road, he was not. Nor have legislators been given any special dispensations from on high. It is therefore man’s lot to discover what rules can best minimize costs and accidents, and maximize speed and comfort. There is no better means of such discovery than the competitive process. Mr. Glumph of the Glumph Highway Company decides upon a set of rules. Each of his competitors decides upon a (slightly) different version. Then the consumer, by his choice to patronize or not, supports one or the other. To the extent that he patronizes Glumph and avoids his competitors, he underwrites and supports Glumph’s original decisions. If Glumph loses too many customers, he will be forced to change his rules (or other practices) or face bankruptcy. In this way the forces of the market will be unleashed to do their share in aiding the discovery process. We may never reach the all-perfect set of rules that maximizes the attainment of all conceivable goals, but the tendency toward this end will always operate.

If a free market in roads is allowed and bankruptcies occur, what will be done about the havoc created for the people dependent upon them?

Bankrupt road companies may well result from the operations of the market. There are insolvencies in every area of the economy, and it would be unlikely for this curse to pass by the road sector. Far from a calamity, however, bankruptcies are paradoxically a sign of a healthy economy.

Bankruptcies have a function. Stemming from managerial error in the face of changing circumstances, bankruptcies have several beneficial effects. They may be a signal that consumers can no longer achieve maximum benefit from a stretch of land used as a highway; there may be an alternative use that is ranked higher. Although the subject might never arise under public stewardship, surely sometime in the past ten centuries there were roads constructed which (from the vantage point of the present) should not have been built; or, even if they were worth building originally, have long since outlasted their usefulness. We want a capacity in our system to acknowledge mistakes, and then act so as to correct them. The system of public ownership is deficient, in comparison, precisely because bankruptcy and conversion to a more valuable use never exists as a serious alternative. The mistakes are, rather, “frozen in concrete,” never to be changed.

Would we really want to apply the present nonbankruptcy system now prevailing in government road management to any other industry? Would it be more efficient to maintain every single grocery store, once built, forevermore? Of course not. It is part of the health of the grocery industry that stores no longer needed are allowed to pass on, making room for those in greater demand. No less is true of the roadway industry. Just as it is important for the functioning of the body that dead cells be allowed to disappear, making way for new life, so is it necessary for the proper functioning of our roadway network that some roads be allowed to pass away.

Bankruptcy may serve a second purpose. A business may fail not because there is no longer any need for the road, but because private management is so inept that it cannot attract and hold enough passengers to meet all its costs. In this case, the function served by bankruptcy proceedings would be to relieve the ineffective owners of the road, put it into the hands of the creditors and, subsequently, into the hands of better management.

How would traffic snarls be countered in the free market?

If the roads in an entire section of town (e.g., the Upper East Side of Manhattan), or all of the streets in a small city were completely under the control of one company, traffic congestion would present no new problem. The only difference between this and the present arrangement would be that a private company, not the government road authority, would be in charge. As such, we could only expect the forces of competition to improve matters.

For example, one frequent blocker of traffic, and one which in no way aids the overall movement of motorists, is the automobile caught in an intersection when the light has changed. This situation arises from entering an intersecting cross street, in the hope of making it across so that, when the light changes, one will be ahead of vehicles turning off that street. In the accompanying diagram 1 (see below) a motorist is traveling west along the Side Street. Although the Side Street west of Main Street is chock full of cars, he nevertheless enters the intersection between Main Street and Side Street; he hopes that, by the time Main Street again enjoys the green light, the cars ahead of him will move forward, leaving room for him to leave the intersection.

Diagram 1

Diagram 1

All too often, however, what happens is that traffic ahead of him on Side Street remains stationary, and the motorist gets caught in the middle of the intersection. Then, even when the traffic is signaled to move north on Main Street, it cannot; because of the impatience of our motorist, he and his fellows are now stuck in the intersection, blocking northbound traffic. If this process is repeated on the four intersections surrounding one city block (see diagram 2) it can (and does) bring traffic in the entire surrounding area to a virtual standstill.

Diagram 2

Diagram 2

Currently, government regulations prohibit entering an intersection when there is no room on the other side. This rule is beside the point. The question is not whether a traffic system legally calls for certain actions, but whether this rule succeeds or not. If the mere passage of a law could suffice, all that would be needed to return to the Garden of Eden would be “enabling legislation.” What is called for, in addition to the proper rules of the road, is the actual attainment of motorists’ conformity with those rules. As far as this problem is concerned, private road companies have a comparative advantage over governments. For, as we have seen, if a government fails in this kind of mission, there is no process whereby it is relieved of its duties; whereas, let a private enterprise fail and retribution, in the form of bankruptcy, will be swift and total. Another street company, and still another, if needed, will evolve through the market process, to improve matters.

It is impossible to tell, in advance, what means the private street companies will employ to rid their territories of this threat.

Just as private universities, athletic stadiums, etc., now enforce rules whose purpose is the smooth functioning of the facility, so might road owners levy fines to ensure obedience to rules. For example, automobiles stuck in an intersection could be registered by the road’s computer-monitoring system, and charged an extra amount for this driving infraction, on an itemized bill.17

What problems would ensue of each street owned by a separate company, or individual?

It might appear that the problems are insoluble. For each owner would seem to have an incentive to encourage motorists on his own street to try as hard as they can to get to the next block, to the total disregard of traffic on the cross street. (The more vehicles passing through, the greater the charges that can be levied.) Main Street, in this scenario, would urge its patrons, traveling north, to get into the intersection between it and Side Street, so as to pass on when the next light changed. The Side Street management would do the same: embolden the drivers heading west to try to cross over Main Street, regardless whether there was room on the other side. Each street owner would, in this view, take an extremely narrow stance; he would try to maximize his own profits, and not overly concern himself with imposing costs on the others.

The answer to this dilemma is that it could never occur in a free market, based on specified individual private property rights. For in such a system, all aspects of the roadway are owned, including the intersection itself: In the nature of things, in a full private property system, the intersection must be owned either by the Main Street Company, the Side Street Company, or by some third party. As soon as the property rights to the intersection between the two streets are fully specified (in whichever of these three ways) all such problems and dilemmas cease.

Suppose the Main Street Company had been the first on the scene. It is then the full owner of an unbroken chain of property, known as Main Street. Soon after, the Side Street Company contemplates building. Now the former company knows full well that all of Main Street is private property. Building a cross street to run over the property of Main Street cannot be justified. The Main Street Company, however, has every incentive to welcome a Side Street, if not to build one itself, for the new street will enhance its own property if patrons can use it to arrive at other places. A city street that has no cross street options does not really function as an access route; it would be more like a limited access highway in the middle of a city. The two companies shall have to arrive at a mutually satisfactory arrangement. Presumably, the Side Street Company will have to pay for the right to build a cross street. On the other hand, if the owners of Main Street intend to use it as a limited access highway, then the Side Street Company shall have to build over it, under it, or around it, but not across it. (As part of the contract between the two parties, there would have to be an agreement concerning automobiles getting stuck in the intersection. Presumably this would be prohibited.)

Since original ownership by the Side Street Company would be the same analytically as the case we have just considered, but with the names of the companies reversed, we may pass on to a consideration of ownership by a third party.

If the intersection of the two streets is owned by an outsider, then it is he who decides conflicts between the two road companies. Since his interests would best be served by smoothly flowing traffic, the presumption is that the owner of the intersection would act so as to minimize the chances of motorists from either street being isolated in the intersection as the traffic light changed.

This analysis of the ownership situation concerning cross streets and their intersections will enable us to answer several other possibly perplexing problems.

How would green light time be parceled out under free enterprise?

Of course, most street owners, if they had their choice, would prefer the green light for their street 100 percent of the time. Yet, this would be tantamount to a limited access highway. If it is to be a city street, a road must content itself with less. What proportion of red and green lights shall be allotted to each street?

If all the streets in one neighborhood are owned by one company, then it decides this question, presumably with the intention of maximizing its profits. Again, and for the same reasons, we can expect a more effective job from such a “private” owner, than from a city government apparatus.

In the case of intersection ownership by a third party, the two cross street owners will bid for the green light time. Ceteris paribus, the presumption is that the owner of the street with the larger volume of street traffic will succeed in bidding for more of the green light time. If the owner of the larger volume street refused to bid for a high proportion of green light time, his customers would tend to patronize competitors—who could offer more green lights, and hence a faster trip.

A similar result would take place with two street owners, no matter what the property dispersal.18 It is easy to see this if the larger street company owns the intersections. The larger company would simply keep a high proportion (two-thirds, three-quarters, or perhaps even four-fifths) of green light time for itself, selling only the remaining small fraction to the intersecting side street. But much the same result would ensue if the smaller road owned the common intersections! Although the relatively lightly traveled road company might like to keep the lion’s share of the green lights for itself, it will find that it cannot afford to do so. The more heavily traveled street, representing a clientele willing and able in the aggregate to pay far more for green light privileges, will make it extremely tempting for the small street owner to accept a heavy payment, in order to relinquish most of its green light time. In other words, the customers of the main street, through indirect payments via the main street owner, will bid time away from the smaller number of customers using the minor street. This principle is well established in business, and is illustrated every time a firm sublets space, which it could have used to satisfy its own customers, because it receives more income subletting than retaining the premises for its own use.

The provision of staggered traffic lights (the lights continually turn green, for example, as an auto proceeding at twenty-five miles per hour approaches them) may present some conceptual difficulties but, again, they are easily overcome. Of course, there are virtually no problems if either one company owns all the roads, or if the main road (the one to be staggered) is continuously owned. The only question arises when the side streets are continuously owned, and it is the main avenues which are to receive the staggered lights. (We are assuming that staggering cannot efficiently be instituted for both north-south and intersecting east-west streets, and that staggering is better placed on the main roads than the side ones.)

Under these conditions, there are several possible solutions. For one, the main avenues, being able to make better use of the staggering system, may simply purchase (or rent) the rights to program the lights so that staggering takes place on the main roads. The side roads, even as owners of the intersections, would only be interested in the proportion of each minute that their lights could remain green; they would be indifferent to the necessity of staggering. Since this is precisely what the main roads desire, it seems that some mutually advantageous agreement could feasibly be made.

Another possibility is that the main roads, better able to utilize the staggering capabilities which intersection ownership confers (and perhaps better able to utilize the other advantages bestowed upon their owners) will simply arrange to purchase the intersections outright. If so, the pattern would change from one where the side street corporations owned the intersections to one in which these came under the possession of the main street companies.

Still another alternative would be integration of ownership. We have no idea as to the optimal size of the road firm (single block, single road, continuous road, small city, etc.), so thoughts in this direction can only be considered speculative. With regard to the ease of coordinating staggered light systems, however, it may well be that larger is better. If so, there will be a market tendency for merger, until these economies are exhausted.

Let us recapitulate. We have begun by indicating the present mismanagement of roads by government. We have claimed that improvements, given the status quo of government management, are not likely to suffice. We have briefly explored an alternative—the free market in road ownership and management—and shown how it might deal with a series of problems, and rejected some unsophisticated objections. We are now ready to examine in some detail how private road owners actually might compete in the market place.

How Private Road Owners Might Compete #

On the rare occasions when the feasibility of private road ownership has been considered by mainstream economists, it has been summarily rejected, based on the impossibility of competition among private road owners. Seeing this point as almost intuitively obvious, economists have not embarked on lengthy chains of reasoning in refutation. Thus, says Smerk, rather curtly, “Highways could not very well be supplied on a competitive basis, hence they are provided by the various levels of government.”19

Economists, however, are willing to expound, at great length, upon the need for the conditions of perfect competition, if efficiency is to prevail in the private sector. One of the main reasons the idea of private enterprise for roads has not been accepted is the claim that perfect competition cannot exist in this sphere.

A typical example of this kind of thinking is that of Haveman.20 Says he:

A number of conditions must be met if the private sector of the economy—the market system—is to function efficiently. Indeed, these conditions are essential if the private sector is to perform in the public interest…. It is the absence of these conditions which often gives rise to demands for public sector [government] action.

These conditions of perfect competition are widely known: numerous buyers and sellers, so that no one of them is big enough to “affect price;” a homogeneous good; and perfect information. One problem with the strict requirement that an industry meet these conditions, or else be consigned to government operation, is that there is virtually no industry in a real-life economy that would remain in the private sector! Almost every industry would have to be nationalized, were the implicit program of Haveman followed. This is easy to see, once we realize how truly restrictive are these conditions. The homogeneity requirement, by itself, would be enough to bar most goods and services in a modern, complex economy. Except for thumb tacks, rubber bands, paper clips, and several others of this kind, there are hardly any commodities which do not differ, even slightly, in the eyes of most consumers. Perfect information bars even the farm staples from inclusion in the rubric of perfect competition. This can be seen in a healthy, functioning Chicago mercantile exchange. If there were full information available to all and sundry, there could be no such commodities market.

Not “affecting price” also presents difficulties. No matter how small a part of the total market a single individual may be, he can always hold out for a price slightly higher than that commonly prevailing. Given a lack of perfect information, there will usually (but not always) be someone willing to purchase at the higher price.

Therefore, the objection to private roads on the ground that they are inconsistent with perfect competition cannot be sustained. It is true that this industry could not maintain the rigid standards required for perfect competition, but neither can most. In pointing out that perfect competition cannot apply to roads, we have by no means conceded that competition between the various road owners would not be a vigorous, rivalrous process. On the contrary, were we to allow that perfect competition could apply to roads, we would then have to retract our claim that vigorous competition could also ensue. For perfect competition, and competition in the ordinary sense of that word (implying rivalry, attempts to entice customers away from one another) are opposites, and inconsistent with each other.21

In the perfectly competitive model, each seller can sell all he wants, at the given market price. (This is the assumption that each perfect competitor faces a perfectly elastic demand curve.) A typical rendition of this point of view is furnished by Stonier and Hague:22

The shape of the revenue curve [demand curve] of the individual firm will depend on conditions in the market in which the firm sells its product. Broadly speaking, the keener the competition of its rivals and the greater the number of fairly close substitutes for its product, the more elastic will a firm’s average revenue curve be. As usual, it is possible to be precise about limiting cases. One limiting case will occur when there are so many competitors producing such close substitutes [the perfectly competitive model] that the demand for the product of each individual firm is infinitely elastic and its average revenue curve is a horizontal straight line. This will mean that the firm can sell as much of its product as it wishes at the ruling market price. If the firm raises its price, then, owing to the ease with which the same, or a very similar, product can be bought from competitors, it will lose all its customers. If the firm were to lower its price, it would be swamped by orders from customers wishing to take advantage of its price reduction. The demand—and the elasticity of demand—for its product would be infinite.

Under these conditions, competition in the usual sense of opposition, contention, rivalry, etc. would be completely lacking. Where is the need to attract the customers of other firms to oneself if each so-called “competitor” can “sell as much of its product as it wishes at the ruling market price?” Why go out and compete if one is guaranteed all the customers one could possibly want? If “competition” is supposed to indicate rivalrous behavior, one would think that “perfect competition” would denote a sort of super-contentiousness. Instead, through dint of misleading definition, it means the very opposite: a highly passive existence, where firms do not have to go out and actively seek customers.

Again, we can see that rejecting the possibility of perfect competition for a roads industry is by no means equivalent to conceding that there can be no rivalrous competition between the different road owners. Paradoxically, only if perfect competition were applicable to roads, might we have to consider the possibility that the process of competition might not be adaptable to highways.

In contrast to the passive notion of perfect competition, which has held center stage in the economics profession for the last few decades, there is a new comprehension of competition, in the market process sense, that is now drawing increasing attention.

Instead of concentrating on the maximization of ends, assuming given scarce means, as does the Robbinsian23 notion of perfect competition, the market process view makes the realistic assumption that the means, although scarce, are in no way given; rather, knowledge of them must actively be sought out. The allocation of scarce means among competing ends is a passive procedure when the means and the ends are known. All that need be done can be accomplished by a suitably programmed computer. But the active seeking out of the ends and the means in the first place is a task that can be accomplished only by entrepreneurial talent; active, not passive. The entrepreneur, denied his crucial role in the perfectly competitive world-view, takes center stage in the market process conception.

Instead of merely economizing, the entrepreneur seeks new and hitherto unknown profit opportunities; not content to allocate given means to already selected ends, the businessman blazes new trails, continually on the lookout for new ends, and different means. States Israel Kirzner,24 one of the pathbreakers in this way of looking at our economy:

We have seen that the market proceeds through entrepreneurial competition. In this process market participants become aware of opportunities for profit: they perceive price discrepancies (either between the prices offered and asked by buyers and sellers of the same good or between the price offered by buyers for a product and that asked by sellers for the necessary resources) and move to capture the difference for themselves through their entrepreneurial buying and selling. Competition, in this process, consists of perceiving possibilities of offering opportunities to other market participants which are more attractive than those currently being made available. It is an essentially rivalrous process… [which]… consists not so much in the regards decisionmakers have for the likely future reactions of their competitors as in their awareness that in making their present decisions they themselves are in a position to do better for the market than their rivals are prepared to do; it consists not of market participants’ reacting passively to given conditions, but of their actively grasping profit opportunities by positively changing the existing conditions.

It is this competitive market process that can apply to the road industry. Highway entrepreneurs can continually seek newer and better ways of providing services to their customers. There is no reason why street corporations should not actively compete with other such firms for the continued and increased tolls of their patrons. There may not be millions of buyers and sellers of road transport service at each and every conceivable location (nor is there for any industry) but this does not preclude vigorous rivalry among the market participants, however many.

How might this work? #

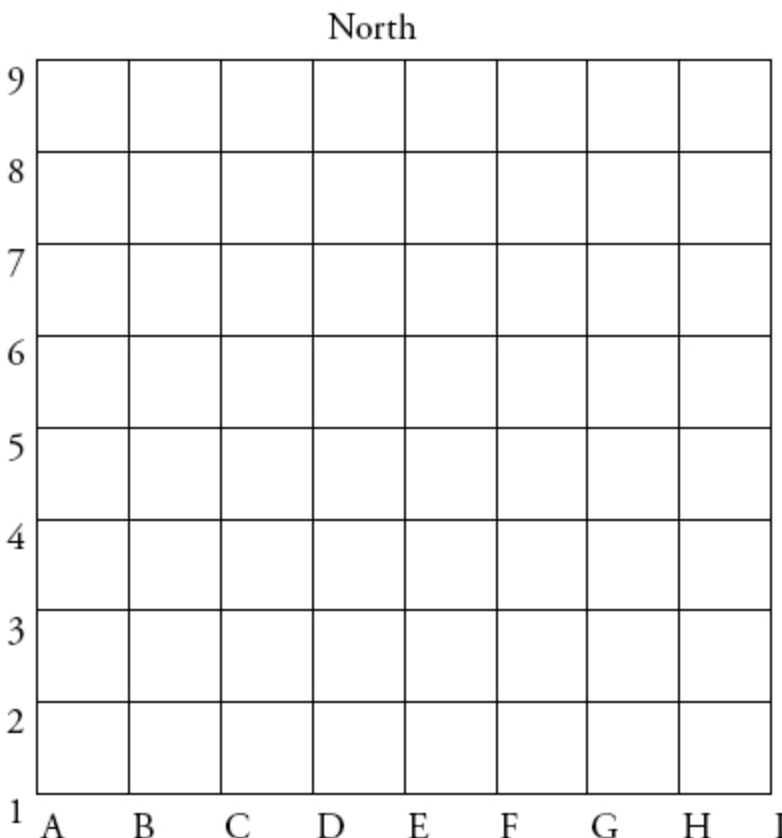

Let us consider, for the sake of simplicity, a town laid out into sixty-four blocks, as in a checkerboard (see diagram 3). We can conveniently label the north-south or vertical avenues A through I, and the east-west or horizontal streets first through ninth. If a person wants to travel from the junction of First Street and Avenue A to Ninth Street and Avenue I, there are several paths he may take. He might go east along First Street to Avenue I, and then north along Avenue I, to Ninth Street, a horizontal and then a vertical trip. Or he may first go north to Ninth Street, and then east along Ninth Street to Avenue I. Alternatively, he may follow any number of zig-zag paths: east along First Street to Avenue B; north along Avenue B to Second Street; east again, along Second Street to Avenue C; north on C to Third Street… etc. Additionally, there are numerous intermediate paths between the pure zig-zag and the one turn.

Diagram 3

Diagram 3

These possibilities do not open an indefinitely large number of paths, as might be required by the dictates of perfect competition. However, they are sufficiently numerous to serve as the basis for rivalrous competition, where one road entrepreneur, or set of entrepreneurs, seeks to offer better and cheaper channels for transportation than others.

Let us consider the traffic that wishes to go from the junction of First Street and Avenue D to Ninth Street and Avenue D. (Intersections can be seen as whole towns or cities, and streets as actual or potential highways.) If Avenue D is owned by one firm, it might be thought that here, no competition is possible. For the best route is obviously right up Avenue D from First to Ninth Street. Even though this is true, there is still potential competition from Avenues C and E (and even from B and F). If the Avenue D Corporation charges outrageous prices, the customer can use the alternative paths of C or E (or, in a pinch, to B or F, or even A or G, if need be). A second source of potential competition derives, as we have seen, from the possibility of building another road above the road in question, or tunneling beneath it. Consider again, the management of Avenue D, which is charging an outrageously high price. In addition to the competition provided by nearby roads, competition may also be provided by double-, triple-, or quadruple-decking the road.

The transportation literature is not unaware of the possibility of double-decking roads, tunneling, or adding overhead ramps. For example, Wilfred Owens25 tells us:

The Port of New York Authority Bus Terminal helps relieve mid-Manhattan traffic congestion. Approximately 90% of intercity bus departures and intercity bus passengers from mid-Manhattan originate at this terminal. The diversion of this traffic on overhead ramps from the terminal to the Lincoln Tunnel has been equivalent to adding three cross-town streets.

John Burchard lauds double-decking as follows:

On one short span of East River Drive [in New York City] there are grassed terraces carried over the traffic lanes right out to the edge of the East River, a special boon for nearby apartment dwellers. The solution was perhaps triggered by the fact that space between the established building lines and the river was so narrow as to force the superposition of the north and south lanes. But this did not do more than suggest the opportunity. Applause goes to those who grasped it, but none to those who with the good example in view so consistently ignored it thereafter. [Emphasis added]26

From Burchard’s limited perspective, it is indeed a mystery that some should have taken this step and that, once it was taken and proven successful, it should not have been emulated. From the vantage point of a market in roads, the mystery disappears: one bureaucrat stumbled, out of necessity, onto a good plan. Having no financial incentive toward cost minimization, no others saw fit to expand this innovation. On the market, given that it is economical to double-deck, there will be powerful forces tending toward this result: the profit and loss system.

An authoritative reference to double-decking was made by Charles M. Noble, former Director of the Ohio Department of Highways and chief engineer of the New Jersey Turnpike Authority:

It seems clear that, ultimately, many urban freeways will become double- or triple-deck facilities, with upper decks carrying the longer distance volumes, possibly with reversible lanes, and probably operating with new interchanges to avoid flooding of existing interchanges and connecting streets.27

It is impossible to foretell exactly how this competition via multiple decking might work out in the real world. Perhaps one company would undertake to build and maintain the roads, as well as the bridgework supporting all the different decks. In this scenario, the road deck owner might sublease each individual deck, much in the same way as the builder of a shopping center does not himself run any of the stores, preferring to sublet them to others. Alternatively, the main owner-builder might decide to keep one road for himself, renting out the other levels to different road companies. This would follow the pattern of the shopping center which builds a large facility for itself, but leases out the remainder of the space.

Whatever the pattern of ownership, there would be several, not just one road company in the same “place;” they could compete with each other. If Avenue D, as in our previous example, becomes multiple decked, then traveling from First Street and Avenue D to Ninth Street and Avenue D need not call for a trip along Avenue C or E, in order to take advantage of competition. One might also have the choice between levels w, x, y, z, all running over Avenue D!

Let us consider the objections of Z. Haritos:

There is joint road consumption by consumers with different demand functions. The road is not as good as steel which may be produced to different specifications of quality and dimensions. The economic characteristics necessitate the production of one kind of road for all users at any given place.28

This statement is at odds with what we have just been saying. In our view, the double- or triple-decking of roads allows for the production of at least several kinds of road along any given roadway. We would then be forced to reject Haritos’s contention. One point of dispute is the equivocation in his use of the word “place.”

For in one sense, Haritos is correct. If we define “place” as the entity within which two different things cannot possibly exist, then logic forces us to conclude that two different roads cannot exist in the same place. But by the same token, this applies to steel as well. Contrary to Haritos, a road occupies the same logical position as steel. If roads cannot be produced to different specifications of quality and dimensions at any given place, then neither can steel.

But if we reverse matters, and use the word “place” in such a way that two different things (two different pieces of steel, with different specifications) can exist in one place (side by side, or close to each other) then steel may indeed be produced to different specifications at any given place, but so may roads! For many different roads, through the technique of multiple decking, can flow along the same pathway, or exist in the same “place.”

Another objection charges that competition among roadway entrepreneurs would involve wasteful duplication. Says George M. Smerk: “Competition between public transport companies, particularly public transit firms with fixed facilities, would require an expensive and undesirable duplication of plant.”29

This is a popular objection to market competition in many areas; railroad “overbuilding,” in particular, has received its share of criticism on this score. However, it is fallacious and misdirected.

We must first of all distinguish between investment ex ante and ex post. In the ex ante sense, all investment is undertaken with the purpose of earning a profit. Wasteful overbuilding or needless duplication cannot exist in the ex ante sense; no one intends, at the outset of his investment, that it should be wasteful or unprofitable.30 Ex ante investment must of necessity, be nonwasteful.

Ex post perspective is another matter. The plain fact of our existence is that plans are often met by failure; investments often go awry. From the vantage point of history, an investment may very often be judged unwise, wasteful and needlessly duplicative. But this hardly constitutes a valid argument against private roads! For the point is that all investors are liable to error. Unless it is contended that government enterprise is somehow less likely to commit error than entrepreneurs who have been continuously tested by the market process of profit and loss, the argument makes little sense. (There are few, indeed, who would be so bold as to make the claim that the government bureaucrat is a better entrepreneur than the private businessman.)

Very often criticisms of the market, such as the charge of wasteful duplication on the part of road owners, stems from a preoccupation with the perfectly competitive model. Looking at the world from this vantage point can be extremely disappointing. The model posits full and perfect information, and in a world of perfect knowledge there of course can be no such thing as wasteful duplication. Ex post decisions would be as successful as those ex ante. By comparison, in this respect, the real world comes off a distant second best. It is perhaps understandable that a person viewing the real world through perfectly competitive-tinged sunglasses should experience a profound unhappiness with actual investments that turn out to be unwise, or needlessly duplicative.

Such disappointment, however, is not a valid objection to the road market. What must be rejected is not the sometimes mistaken investment of a private road firm, but rather the perfectly competitive model which has no room in it for human error.

An intermediate position on the possibility of road competition is taken by Gabriel Roth. He states:

While it is possible to envisage competition in the provision of roads connecting points at great distances apart—as occurred on the railways in the early days—it is not possible to envisage competition in the provision of access roads in towns and villages, for most places are served by one road only. A highway authority is in practice in a monopoly position. If any of its roads were to make large profits, we could not expect other road suppliers to rush in to fill the gap. If losses are made on some roads, there are no road suppliers to close them down and transfer their resources to other sectors of the economy.31

Here we find several issues of contention. First, it is a rare small town or village that is served by only one road, path, or cattle track. Most places have at least several. But even allowing that in many rural communities there is only one serviceable road, let us note the discrepancy in Roth between roads and other services. Most local towns and villages are also served by only one grocer, butcher, baker, etc. Yet Roth would hardly contend that competition cannot thereby exist in these areas. He knows that, even though there is only one grocer in town, there is potential, if not actual competition from the grocer down the road, or in the next town.

The situation is identical with roads. As we have seen, there is always the likelihood of building another road next to the first, if the established one proves highly popular and profitable. There is also the possibility of building another road above, or tunneling beneath the first road. In addition, competition is also brought in through other transportation industries. There may be a trolley line, railroad or subway linking this town with the outside world. If there is not, and the first established road is very profitable, such competition is always open in a free market.

Finally, we come to the statement, “If losses are made on some roads, there are no road suppliers to close them down and transfer their resources to other sectors of the economy.” We agree, because a road is generally fixed, geographically. An entrepreneur would no more “move” a no longer profitable road, than he would physically move an equivalently unprofitable farm or forest. More importantly, even if it were somehow economically feasible to “move” an unprofitable road to a better locale, there are no such road suppliers simply because private road ownership is now prohibited.

With Roth’s statement, we also come to the spectre of monopoly, and to claims that a private road market must function monopolistically. Why are such claims made? There are two reasons usually given. First, indivisibilities—the fact that many factors of production cannot be efficiently utilized at low levels of output. A steel mill or automobile factory cannot be chopped in half and then be asked to produce one-half of the output it had previously been producing.

Says Mohring, “But indivisibilities do exist in the provision of transportation facilities. Each railroad track must have two rails, and each highway or country road must be at least as wide as the vehicles that use it.”32 In similar vein, says Haritos, “To get from A to B, you need a whole lane, not just half, for the full distance, not half of it.”33 And, in the words of Winch, “indivisibility of highways make it impractical to have competing systems of roads, and the responsible authority must therefore be a monopoly.”34

We do not believe that the existence of indivisibilities is enough to guarantee monopoly, defined by many as a situation in which there is a single seller of a commodity. There are indivisibilities in every industry, and in all walks of life. Hammers and nails, bicycles and wheelbarrows, locomotives and elevators, tractors and steel mills, professors and podiatrists, ballet dancers and bricklayers, musicians and motorists, ships and slippers, buckets and broomsticks, none of them can be chopped in half (costlessly) and be expected to produce just half of what they had been producing before. A railroad needs two rails (with the exception, of course, of the monorail), not one, or any fraction thereof. Also, in order to connect points A and B, it must stretch completely from one point to the other. It may not end halfway between them, and offer the likelihood of transportation between the two points.

Does this establish the need for government takeover of railroads? Of course not. Yet they exhibit the concept of indivisibilities just as do roads and highways. If indivisibilities justify government involvement in roadways, then they should justify it in all other cases wherein indivisibilities can be found. Since the advocates of the indivisibility argument are not willing to extend it to broomsticks, slippers, steel mills, and practically every other good and commodity under the sun, logic compels them to retract it in the case of highways.

Conclusion #

So what do we conclude? Having debunked the notion that private ownership of the roads is not “impossible,” and that, in fact, it may offer a variety of exciting alternatives to the present system, we return to the question of why should it even be considered. There we come face-to-face again with the problem of safety. A worse job than that which is presently being done by the government road managers is difficult to envision. We need only consider what transpires when safety is questioned in other forms of transportation to see a corollary. When an airline experiences an accident, it often experiences a notable dropping off of passengers. Airlines with excellent safety records, who have conducted surveys, have found that the public is aware of safety and will make choices based upon it.

Similarly, private road owners will be in a position to establish regulations and practices to assure safety on their roads. They can impact on the driver, the vehicle, and the road—the key elements of highway safety. They can react more quickly than the government bureaucracy in banning such vehicles as “exploding Pintos.” The overriding problem with the National Highway Traffic Safety Administration, and with all similar governmental systems of insuring against vehicle defects, for example, is that there is no competition allowed. Again, in a free market system, opportunities would open up for innovative approaches to safety problems. Should stiffer penalties be shown unsuccessful in reducing unsafe vehicles and practices, an incentive system may be the answer. We cannot paint all the details of the future from our present vantage point. But we do know that “there has to be a better way.”

Reprinted with kind permission of the Ludwig von Mises Institute from Journal of Libertarian Studies 3, no. 2 (1979): 209–38.

The number of people who were victims of motor vehicle accidents in 1976, in National Safety Council (1977, p. 13). ↩︎

The number of road and highway deaths in the decade 1967–1976, in ibid. ↩︎

Data for 1968, in ibid., p. 57. ↩︎

Data far 1969, in ibid., p. 60. ↩︎

Statement by Charles M. Noble, distinguished traffic engineer who served as director of the Ohio Department of Highways, chief engineer of the New Jersey Turnpike, and recipient of the Matson Memorial Award for Outstanding Contributions to the Advancement of Traffic Engineering. “Highway Design and Construction Related to Traffic Operations and Safety,” Traffic Quarterly (November 1971, p. 534). ↩︎

National Safety Council (1977, p. 13). ↩︎

Regulation and Automobile Safety (1975, pp. 8–9). ↩︎

Winch (1963, p. 87). ↩︎

Strictly speaking, this is far from the truth. Before the nineteenth century, most roads and bridges in England and the U.S. were built by quasi-private stock companies. ↩︎

Wooldridge (1970, pp. 7–9). ↩︎